We all have experienced it, ready to make a purchase on our smartphones from literally anywhere. Technology has made this process magically simple, one click of the button and it’s done. But behind that single click, there’s a lot of complexity and information exchange between many different players.

How does the money actually move from your bank account to the business’s account when you make a purchase online? In this post, I will dive deeper into this question.

Whether you’re involved in ecommerce systems, working in roles such as development, customer support, sales or simply curious as an everyday consumer — you can benefit from understanding this process given the enormous scale of the industry.

The Digital Payments market has a global transaction value of US$8,487.9 billion in 2022 and is the largest segment within FinTech.

https://www.statista.com/study/41122/fintech-report-digital-payments/

Steps in the card payment process

Disclaimer: In this article I focus mostly on card payments. Although the world of payments has more variety to it nowadays, I think card payments are a good place to start.

I might get into different payment methods as well in other articles.

From the perspective of online business and getting money from the customers card payment flow could be divided into 2 main steps.

Authorization

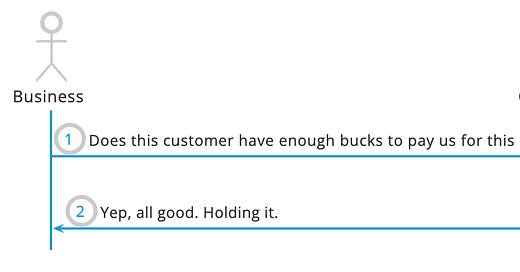

While what authorization aims to achieve could seem simple as shown above, in reality business’s online platform does not connect directly to the customer’s bank to move money.

During authorization process, payment information travels between involved parties to verify that customer is presenting a valid card at the checkout, this is not a fraudulent activity and they have enough money in the bank to make a payment.

After authorization is successfully obtained, ecommerce store will place an order in the system and send out a confirmation email to the customer that payment went through.

Customer will be notified by the ecommerce store in an email that order has been placed and they will see so called authorization hold on their bank account for the money that they paid for that purchase. This is money that is technically still on their account, but they cannot really use it anymore. Account balance will be decreased by this amount.

As a customer you can see authorization hold on your account following a purchase with duration ranging from a few seconds or minutes up to few days - it depends on the business’s order and payment processing.

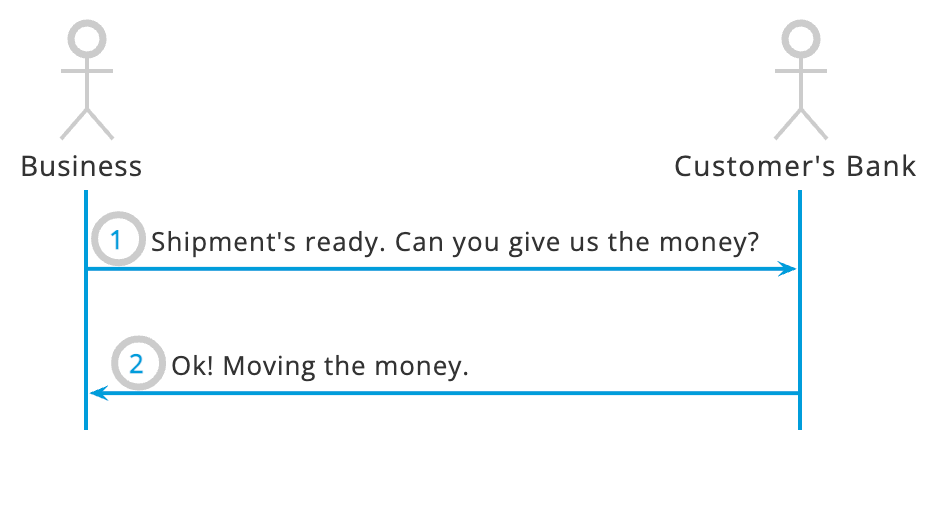

However, authorization has an expiration time (which depends on the customer’s bank) - so in order to not be released by the bank and go to waste, it needs to be captured in time.Capture

This is the final operation where business sends out request for the actual money movement from the customer’s bank account to their own.

In the previous step customer’s bank ensured that necessary funds are present and locked them for transaction purposes and now it’s time to actually move those money. This is usually when the order is shipped out and travels to your shipping address.

In the ecommerce payment lifecycle, the capture response that is received from PSP is considered final and ends the process. In reality it does not necessarily mean that actual money movement has occurred, but rather that request has been received and it will be completed during settlement.

Settlement is when money is actually moved between the banks and usually happens as a batch process.

Who’s involved in the payment process

Now let’s dive into the players involved in the payment process and how they’re referred to in the industry language. Additionally, what is important to understand the process - who they have direct relationship with.

Customer (Cardholder) - Presents card at the checkout.

Ecommerce store (Merchant) - Integrates to Payment Service Provider to accept payments for the purchased goods or services.

Payment Service Provider (PSP, Payment processor) e.g. Stripe, Paypal, Adyen, Klarna, Checkout.com - Accepts (via payment gateway) and processes payments on behalf of the business. Connects to acquirers to facilitate this process.

Payment Service Providers processing payments globally must establish relationships with local acquirers in the regions they operate in.

Business’s bank (Acquirer, Acquiring Bank, Merchant Acquirer) - Bank holding the business’s account. Payment processor needs to partner up with licensed (by Card Network) Acquirer in order to be able to process payments over the Card Network.

Card Network (Card scheme) e.g. Visa, Mastercard, Amex - Infrastructure sitting between Acquirer and Issuer, in the industry terms commonly referred to as “payment rails”.

Customer’s bank (Issuer, Issuing Bank) - Bank holding the customer’s account and issuing card to the customer.

Capture timing strategies: Finding the sweet spot

When integrating payments to your online business platform you need to think how you’re going to capture money from the customers, there are a few possible options to consider:

Separate authorization and capture - An explicit capture request needs to be triggered.

Pros: Flexibility, allows to incorporate all necessary checks into the fulfillment process

Cons: Complexity, authorization can expire if not captured in time

Automatic capture - Money is captured immediately after authorization

Pros: Simplicity

Cons: No time to perform additional checks

Delayed capture - Money is captured at a specified time interval after authorization.

Pros: Capture automatically triggered by Payment Service Provider, time to perform additional checks

Cons: Potentially keeping the delay longer than necessary, transactions kept in pending state in prolonged period.

And few other things to consider:

Once you capture the money's gone and you need to make a refund which is typically more costly and takes longer to process compared to canceling an authorization.

Authorization has an expiration time, money needs to be captured in time.

There are payment methods that do not support separate capture.

There’s inherently more risk of technical issues when capture is performed as a separate operation which could potentially lead to lost revenue for the business.

When there is a long delay between authorization and capture customers could become concerned or confused.

So for example if you’re selling digital products like ebooks or online courses - you would prefer to use automatic capture as the delivery of the product happens immediately after the checkout.

However if you’re selling physical products you might want to wait until you have a confirmation about item availability and you’re sure that the order can be shipped before you capture the funds.

In this case you could use separate capture at the time of the shipment or you could still benefit from automation on PSP side offered by capture delay which gives you time to perform required checks.

Great read!